An essential aspect of any business is managing funds, but doing so may be difficult and time-consuming. However, handling your money is made easy with the Integration of two effective software programs: QuickBooks and Invoice Ninja.

We’ll explore the advantages of merging these two systems in this blog, including how it streamlines bookkeeping and improves business operations.

An overview of invoice Ninja and QuickBooks

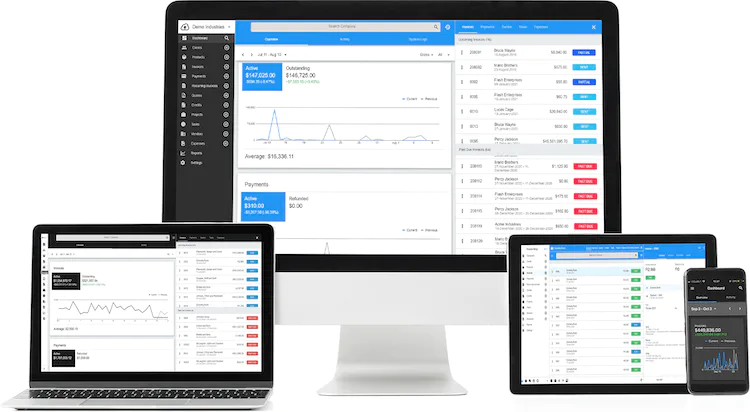

Invoice Ninja and QuickBooks are well-liked accounting software packages serving companies of all sizes.

With a user-friendly interface that makes accounting activities easier for small to medium-sized enterprises, Invoice Ninja specializes in time tracking, expenditure management, and invoicing. Conversely, Intuit’s QuickBooks is well renowned for having a wealth of capabilities, which makes it a great option for handling intricate financial duties like payroll, invoicing, and bookkeeping.

Why Small and Medium-Sized Businesses Should Use Quickbooks

Integration is required whether your firm has outgrown its spreadsheets and you wish to switch from manual to digital accounting, or if you simply need a better tool than your present accounting software.

QuickBooks can be a great and cost-effective option in this scenario. Integrations are similar to enchanted bridges that link Invoice Ninja to other online solutions.

Here are a few advantages of utilizing QuickBooks in your company.

1). Accurate Payroll

Payroll errors can lead to large fines and disgruntled employees. QuickBooks has a payroll function that calculates and runs payroll automatically when it is needed. It ensures that all financial statements for the business are up to date based on the most recent payroll run.

2). Managing Bills and Expenditures

In the professional world, numerous expenses are often accrued in the course of conducting business. These expenses are then billed to clients for reimbursement. They can vary from small expenses like mileage and meals to significant ones such as extensive international travel.

To effectively track all these expenses, QuickBooks offers a feature that enables users to record them irrespective of their magnitude or nature. Furthermore, costs can be categorized under specific clients or jobs, eliminating the need for manual reconciliation and saving users significant time.

3). Controlling Financial Gains and Revenue

QuickBooks serves as a valuable tool for businesses seeking to handle their income and monitor customer sales through the creation of invoices.

The benefits are two-fold as QuickBooks allows companies to effortlessly review the amount owing to them. Resourceful details about current and previous invoices await through the use of accounts receivable aging reports.

4). Streamlining Sales Invoicing

The process of creating invoices can be a time-consuming task, especially without the aid of suitable software. However, with QuickBooks, this arduous process is simplified as it automatically tracks sales and swiftly generates receipts and invoices with just the click of a button.

In addition, team members from the accounts department can effortlessly email these invoices to customers promptly. QuickBooks goes beyond catering to individual invoices, allowing for the billing of large batches as well. Users subscribed to QuickBooks merchant services also have the convenient option of accepting credit and debit card payments within QuickBooks Pro.

Well, having seen the benefits of QuickBooks, it is important to integrate Invoice Ninja with it.

Advantages of Integration

The Integration of QuickBooks and Invoice Ninja presents numerous benefits for enterprises:

a) Time and Efficiency Gains

The amalgamation of the two platforms eradicates redundant data input, resulting in time saved and reduced potential for mistakes. This Integration streamlines the transfer of financial data, facilitating seamless synchronization between the two programs

b) Create Sophisticated Invoicing and Streamlined Payments

Invoice Ninja surpasses at crafting professional invoices, and through integration, the ability to effortlessly transfer this information to QuickBooks is granted for seamless monitoring of payments and receivables.

c) Enhanced Management of Cash Flow

The integration permits real-time monitoring of monetary activities, an invaluable tool for overseeing cash flow and making well-informed financial judgments.

d) Extensive Accounts Analysis

By merging data from both QuickBooks and Invoice Ninja, extensive financial reports are at your disposal, providing a profound understanding of the financial well-being of your enterprise.

e) Elevated Financial Accuracy

Through merged information, you can guarantee that your financial documentation remains current and uniform across all mediums. This leads to heightened accuracy in reporting and decision-making.

How to connect Invoice Ninja and QuickBooks Online

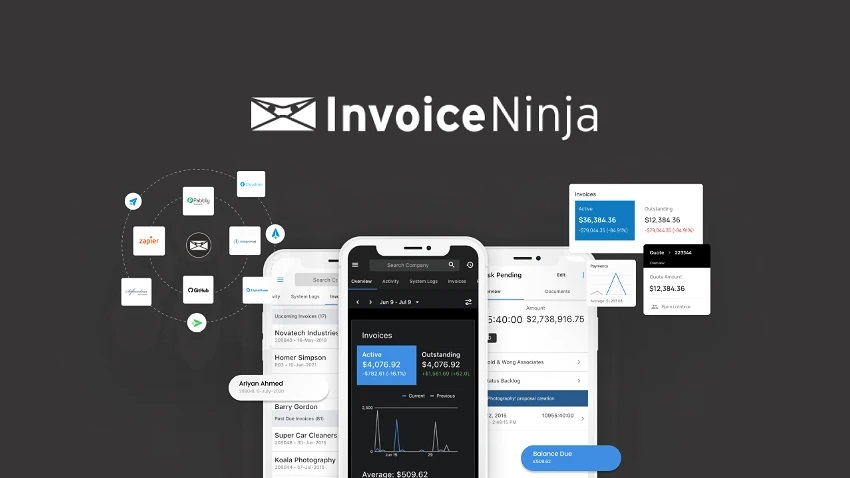

Connecting Invoice Ninja with QuickBooks can be seamlessly accomplished using Zapier, a prominent automation tool for software applications. This powerful platform enables you to effortlessly build workflows, consisting of automated tasks, between different apps. With over 5,000 supported applications, the possibilities for integration are boundless. Furthermore, Zapier allows for seamless communication between Invoice Ninja and QuickBooks Online, eliminating the need for coding.

Here’s how the integration between Invoice Ninja and QuickBooks Online works:

Step 1: Authenticate your accounts for Invoice Ninja and QuickBooks Online.

Step 2: Choose one of the apps as the trigger for your automation.

Step 3: Select a resulting action from the other app.

Step 4: Pick the data you wish to transmit from one app to the other.

What Data Can Be Imported And Exported Between Invoice Ninja And QuickBooks

If you’re using Invoice Ninja and QuickBooks, you can easily share and move important information between them.

This can be super helpful for managing your accounts, clients, vendors, new products, orders, invoices, and payments. All these data can be exported and imported from one platform to another for seamless workflow.

Enhancing Business Processes

The integration of Invoice Ninja and Quickbooks presents businesses with added advantages, equipping them to enhance efficiency, minimize expenses, and optimize operations. Once the integration is operational, businesses can leverage its benefits to streamline various financial and operational aspects.

a) Third-Party Apps Integration

Integrating with a diverse selection of third-party applications, Invoice Ninja and QuickBooks allow for an elevated financial management experience. Not only can these platforms integrate with payment processing services, but also customer relationship management software, project management tools, and e-commerce platforms. This cohesive ecosystem streamlines and automates various business operations, leading to a more organized and efficient workflow.

b) Time Tracking and Payroll

Invoice Ninja allows for tracking of billable hours, which can be seamlessly incorporated into QuickBooks for precise payroll calculations and employee compensation.

c) Tax Preparation and Compliance

Sharing financial data between both platforms simplifies tax preparation, facilitating compliance with tax regulations.

d) Inventory Management:

For businesses managing inventory, integrating Invoice Ninja with QuickBooks enables real-time tracking of stock levels, sales, and purchases.

e) Data Security and Privacy

In this digital era, concerns surrounding data security are warranted. However, both Invoice Ninja and QuickBooks prioritize the protection of sensitive financial information, implementing robust encryption and authentication measures. These platforms also adhere to industry standards and regulations, ensuring data privacy and providing businesses with peace of mind.

f) Improved Client Management:

The integration streamlines the process of managing clients as customer information from invoice Ninja can be shared with QuickBooks, ensuring consistency across client records.

g) Streamlined Bookkeeping

Integrated systems greatly improve the efficiency of bookkeeping as data from Invoice Ninja, such as income and expenses, is automatically updated in QuickBooks.

Other ways to integrate Invoice Ninja with Quickbooks

01). n8n lets you integrate Invoice Ninja with QuickBooks Online to build powerful workflows. Design automation that extracts, transforms, and loads data between your apps and services.

02). With Make you can visually integrate Invoice Ninja and QuickBooks into any workflow to save time and resources — no coding is required

Other Invoice Ninja Integrations

Invoice Ninja is a convenient tool that integrates seamlessly with over 1000 diverse web applications. This enables it to effortlessly work in tandem with other software and perform automated tasks. Let’s delve deeper into some of the top-rated apps that can be seamlessly synchronized with Invoice Ninja:

a. Google Sheets

This is an online spreadsheet tool that enables users to create and modify spreadsheets on the web. It is extremely beneficial for organizing and managing data.

b. Stripe

When it comes to receiving online payments, Stripe is a reliable go-to. Serving as a virtual wallet, it facilitates the transfer of funds from customers to your account.

c. PayPal

Similar to Stripe, PayPal is also a reliable option for collecting payments online. It provides an additional avenue to ensure timely compensation for your work.

e. WooCommerce

If you wish to sell goods on the internet, WooCommerce is a fantastic option. Serving as a virtual storefront, it transforms your website into an online shop to facilitate easy purchasing.

f. Skedda

Imagine having a calendar that can effortlessly manage your appointments and reservations. Well, that’s exactly what Skedda offers. It helps you stay on top of your schedule with ease.

Bottom Line

The Integration of Invoice Ninja and QuickBooks offers a prime prospect for enterprises to streamline their monetary procedures and procure a competitive advantage.

By leveraging the capabilities of these two accounting platforms, businesses can attain superior effectiveness, heightened accuracy, and amplified financial regulation.

Enabling this integration empowers business proprietors and finance departments to prioritize growth strategies over tedious financial duties.