Last updated on November 6th, 2023 at 05:07 am

Invoice Ninja is an open-source billing software that can automatically create QR codes for Swiss payments and SPC QR code invoicing.

Invoice Ninja QR Code is a powerful feature that allows users to create QR codes containing relevant data for Swiss payments, SEPA ERC, and generic payment link QR codes.

With this feature, users can easily let anyone pay using a QR code using their banking app.

This feature is especially useful for businesses that want to streamline their payment processes and make it easier for customers to pay their invoices.

In this article, we will explore what QR codes are, their history, the advantages of QR codes in business and finance, and common use cases for QR codes.

Understanding QR Codes

QR codes have become increasingly popular in recent years, and their use has expanded beyond their original purpose of tracking automobiles throughout the manufacturing process.

A QR code is a type of matrix barcode that can be read by smartphones and scanned with dedicated QR code readers.

These codes allow users to quickly access text, contact information, website URLs, and more.

QR codes offer multiple benefits to businesses, such as increased exposure, inexpensive advertising, data collection, convenience to customers, and more.

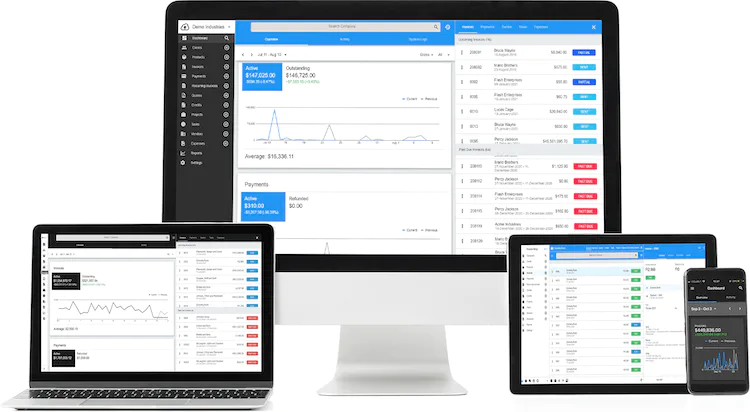

Invoice Ninja: An Overview

Invoice Ninja is a free, open-source invoicing and billing software designed for small to medium-sized businesses and freelancers.

It offers a complete suite of invoicing and payment tools that help businesses streamline their invoicing and payment processes, saving time and money.

With Invoice Ninja, users can create and send professional invoices, track expenses, manage vendors, and accept payments online.

Invoice Ninja is easy to use, customizable, and integrates with multiple payment gateways, making it a popular choice for businesses worldwide.

Key Features and Benefits

Invoicing: Create and send professional invoices, recurring invoices, and quotes in seconds.

Customize invoice templates with your logo and branding. Clients can pay invoices online with one click using multiple payment gateways.

Expense Tracking: Easily create and manage expenses, convert and invoice clients for expenses, create vendors and organize categories. Generate expense reports and vendor statements.

Time Tracking: Create projects, and tasks, and track billable work hours. Send billable tasks to invoice with one click. Accurately record every second spent on each task.

Payment Gateways: Invoice Ninja integrates with multiple payment gateways across the world, allowing clients to pay invoices in one click.

Payment gateways include Stripe, WePay, Authorize.net, Checkout.com, GoCardless, Square, Mollie, PayFast, PayTrace, RazorPay, Eway Rapid, Forte, and more.

Dashboard: Set dashboard data date-range parameters, view revenue, client activity, and system logs, and navigate through system logs and data records.

The Role of QR Codes in Invoicing

QR codes have become increasingly popular in the invoicing and payment ecosystem, offering a quick and easy way to make and track payments.

The implementation of QR codes in invoicing processes has simplified communication and detection of tax fraud, making it a popular choice for businesses worldwide.

Let’s explore the integration of QR codes into the invoicing and payment ecosystem.

Enhancing the Invoicing Process with QR Codes

QR codes can enhance the invoicing process in several ways, including:

1. Speeding up the payment process

QR codes are increasingly being included on print, PDF, or digital invoices to speed up the payment process.

They reduce issues like forgotten passwords, the impact of employee turnover, and human error.

2. Simplifying payments for customers

QR codes allow customers to access digital payment interfaces, review bills, and complete transactions seamlessly.

They make it easier for them to pay their invoices.

3. Eliminating the need for point-of-sale technology

For B2C companies, QR codes eliminate the need for point-of-sale technology.

They make it easier for businesses to accept payments.

4. Direct payments for B2B operations

QR codes allow B2B companies to save money on third-party fees, avoid hosting sensitive customer data, and potentially streamline invoicing.

Real-World Examples of Businesses Using QR Codes with Invoice Ninja

1. Restaurants and Cafés: Displaying QR codes on tables or bills allows customers to access digital payment interfaces, review bills, and complete transactions seamlessly.

2. Online Shopping: QR code payments are used during online checkout processes, directing customers to payment gateways or QR code mobile payment apps for secure transactions.

3. Paper Invoices: Printing a QR code on a paper bill gives customers a quick way to pay, removing barriers that might lead someone to delay payment.

4. In-Person Payments: QR codes can be used to take in-person payments without point-of-sale hardware, making it easier for businesses to accept payments

Creating QR Codes in Invoice Ninja

One of the key features of Invoice Ninja is the ability to generate QR codes.

Let’s look at the step-by-step guide on how to generate QR codes using Invoice Ninja.

Generating QR Codes in Invoice Ninja

To generate a QR code in Invoice Ninja, follow these simple steps:

1. Log in to your Invoice Ninja account and navigate to the invoice you want to generate a QR code for.

2. Click on the “More Actions” button and select “Generate QR Code” from the dropdown menu.

3. Choose the type of QR code you want to generate, such as Swiss QR, SEPA ERC, or generic payment link QR code.

4. Customize the QR code by selecting the design and data encoding options that best suit your needs.

5. Click on the “Generate QR Code” button to create the QR code.

6. Download or copy the QR code and add it to your invoice or payment request.

Customization Options for QR Codes

Users can customize the following aspects of their QR codes:

Design: Users can customize the color, shape, and logo of their QR codes using third-party services like QR.io.

Data Encoding: Users can choose the type of data encoding they want to use, such as UTF-8, ISO-8859-1, or Shift_JIS.

Generating QR codes in Invoice Ninja is a simple process that can be completed by users of varying technical expertise.

The user-friendly interface and step-by-step instructions make it easy for users to create and customize QR codes for their invoices and payment requests.

Additionally, Invoice Ninja offers a helpful community forum where users can ask questions and get support from other users.

Benefits of Using QR Codes in Invoicing

Incorporating QR codes in your invoices can offer several advantages, including:

Streamlining Payments: QR codes expedite payments, reducing forgotten passwords, employee turnover issues, and human errors.

Enhanced Customer Experience: QR codes grant customers easy access to digital payment interfaces, bill reviews, and seamless transactions, simplifying invoice payments.

QR codes streamline the payment process, eliminate manual data entry, enhance accuracy, and offer a contactless payment option, reducing the risk of spreading germs and viruses.

Improved Security and Convenience: QR codes provide secure, convenient payment and tracking, eliminating the need for point-of-sale technology and reducing fraud risks.

They can function in offline environments, making them a reliable payment option in areas with limited or no internet connectivity

QR Code Security and Data Protection

Security Concerns Related to QR Codes

QR codes have been associated with several security concerns, including:

Fraud: QR codes can be easily copied or manipulated, leading to fraudulent transactions.

Data breaches: QR codes can contain sensitive information, such as bank account details, that can be accessed by unauthorized users.

Malware: QR codes can be used to distribute malware, leading to security breaches.

How Invoice Ninja Ensures the Safety of User Data

Invoice Ninja takes several measures to ensure the safety of user data, including:

Encryption: Invoice Ninja uses SSL encryption to protect user data during transmission.

Secure payment gateways: Invoice Ninja integrates with multiple secure payment gateways, such as Stripe and PayPal, to ensure secure transactions.

Password protection: Invoice Ninja allows users to password-protect sensitive information, such as invoices and quotes, to restrict access to certain users.

User access control: Invoice Ninja allows users to control access to their account by setting up user roles and permissions.

Best Practices for Maintaining Data Privacy When Using QR Codes in Invoicing

1. Use secure payment gateways.

2. Limit the amount of sensitive information included in QR codes.

3. Password-protect sensitive information.

4. Use reputable QR code generators.

5. Educate users.

Conclusion

Incorporating QR code into the Invoice Ninja platform has transformed the invoicing and payment landscape.

It accelerates payments, elevates customer satisfaction, and bolsters security.

The seamless, error-free experience and the added benefit of contactless payments make this integration a must for modern businesses.

Embrace the future with Invoice Ninja and QR code for streamlined, secure, and convenient invoicing and payment processes.